Ever feel like your money disappears quickly? You’re not alone. It’s not just about making more money. It’s also about stopping small habits of overspending that can empty your wallet.

A recent report by the Federal Reserve Board shows a worrying trend. More Americans are struggling financially. With 35% of adults saying they’re worse off in 2022, it’s key to spot and stop money-wasting habits.

This isn’t about cutting back on everything. It’s about making better choices. By focusing on the 15 main areas where people overspend, you can change your financial situation for the better.

Table of Contents

Understanding Financial Waste in Modern Life

Many Americans struggle with financial literacy. Recent data shows a tough personal finance landscape. This has big effects on building wealth over time. In 2022, adults in the US saw a 5% drop in financial well-being, showing the need for better budgeting.

Impact of Poor Spending Habits on Long-term Wealth

Your spending choices today affect your future finances. Here are some key points:

- 73% of adults reported being just okay financially in 2022

- 35% felt financially worse off than the previous year

- Households waste an average of $907 annually on food alone

Common Financial Pitfalls in Daily Life

Mindful spending means knowing common money-wasting habits. Americans face several financial challenges often:

- Impulse buying (94% admit to this behavior)

- Unused subscriptions

- Late payment fees

“Your money is a tool, not a limitation. Understanding how to use it effectively is the key to financial freedom.”

The Psychology Behind Wasteful Spending

Financial choices are often driven by emotions, not logic. Social pressures and habits also play a big role. By understanding these, you can make smarter financial choices that help you reach your goals.

Recognizing and changing these spending patterns is crucial for a secure financial future.

Daily Coffee and Beverage Expenses

Did you know your daily coffee habit could cost you nearly $2,900 annually? For many Americans, saving money starts with knowing how small daily purchases add up. With 73% of Americans drinking coffee every day, these purchases can quickly become a big money leak.

“Your morning coffee might taste great, but it could be brewing financial trouble.”

Here are some money-saving tips for coffee lovers:

- Brew coffee at home instead of buying daily cafe drinks

- Invest in a quality coffee maker

- Use reusable cups for potential discounts

- Limit expensive specialty drinks

Here are some surprising coffee consumption statistics:

| Statistic | Percentage |

|---|---|

| Daily Coffee Drinkers | 73% |

| People Drinking 3-5 Cups Daily | 36% |

| Weekly Coffee Shop Purchases | 51% |

| Home Coffee Brewing (Daily) | 66% |

By using smart money-saving tips and watching your beverage expenses, you can save hundreds of dollars a year. Remember, saving money doesn’t mean giving up fun. It’s about making smart choices that help your financial future.

Habits That Waste Money Through Technology

Technology has changed our lives, but it can also cost a lot. It’s important to know how digital habits affect your budget. This knowledge helps you save money and stay financially disciplined.

Unnecessary Smartphone Upgrades

Phone makers always come out with new models, making us think our phones are outdated. Many people upgrade every year, spending a lot of money on small changes. It’s better to focus on what your phone can do, not just its newness.

- Check if your phone still works well before buying a new one

- Don’t upgrade for at least 2-3 years

- Think about buying older models or refurbished phones

Excessive Subscription Services

Digital subscriptions can quietly hurt your wallet. A 2022 CNBC report found people spend $100 to $199 a month on subscriptions. Sadly, 42% of them keep paying for services they don’t use.

“Small monthly fees add up to big yearly costs if you don’t watch them.”

Gaming and Digital Content Purchases

Digital games and content can quickly spend your money. Buying things in games, downloading extra content, and buying new games often can empty your wallet.

- Have a budget for digital fun each month

- Try free games instead

- Wait for sales before buying games

Being smart with your money can help you manage tech costs. Check your digital spending often, cancel services you don’t need, and think carefully before buying things.

Food-Related Money Drains

Your kitchen and dining habits can quietly hurt your wallet. The average family throws away $1,500 a year on food they don’t eat. Being mindful of your spending is key to saving money on food.

“Every meal planned is a dollar saved” – Budget Conscious Living

Start by understanding how much you spend on food. Here are some tips to help you save:

- Meal planning to reduce impulse purchases

- Cooking at home instead of dining out

- Buying generic brands

- Using grocery store loyalty programs

Convenience foods and eating out too much can empty your wallet fast. Meal kits, which cost $10-$15 per person per meal, are a big unnecessary expense. Cooking at home can save you hundreds each month.

| Expense Category | Annual Cost | Potential Savings |

|---|---|---|

| Restaurant Meals | $3,000 | $1,500 |

| Food Waste | $1,500 | $750 |

| Meal Kits | $2,400 | $1,800 |

Smart grocery shopping can cut your food costs a lot. Keep track of your spending, buy in bulk when it makes sense, and shop when you’re not hungry. This way, you’ll make better financial choices.

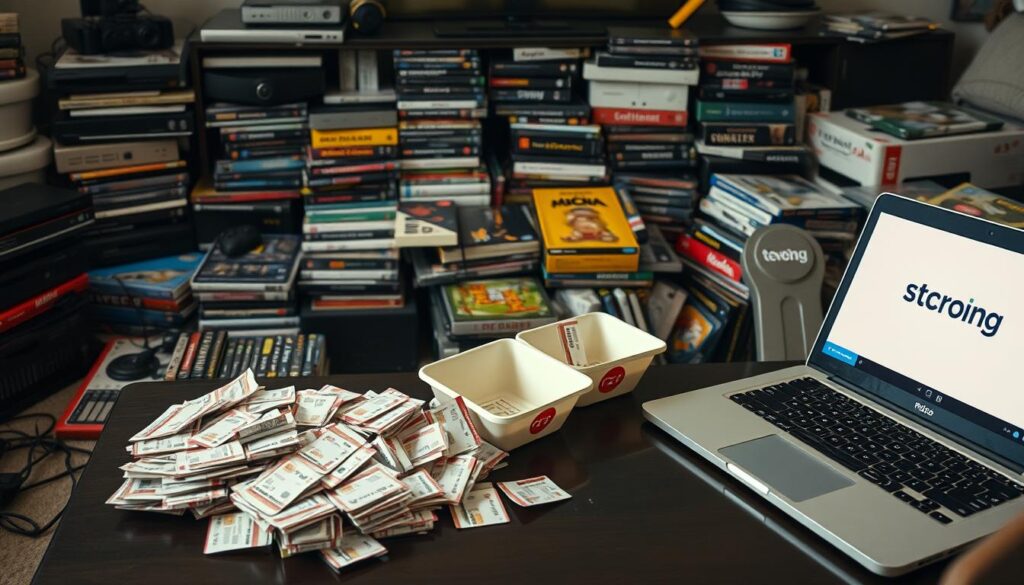

Impulsive Shopping Behaviors

Impulse buying is a big financial problem for many Americans. The desire for quick satisfaction often leads to buying things we don’t need. This can quickly use up our money. Studies show that Americans spend about $150 a month on impulse buys, which adds up to $1,800 a year.

It’s important to understand why we buy things on impulse. Being mindful of our spending helps us avoid unnecessary purchases. Knowing what makes us want to buy things we don’t need is key.

Online Shopping Traps

Digital stores use tricks to get us to buy more:

- Limited-time offers that create artificial urgency

- Targeted advertising based on browsing history

- One-click purchase options

- Personalized recommendations

Brand Name Obsession

Many people think expensive brands are better. Mindful spending means looking at the real value of a product, not just the brand name.

Sale Item Hoarding

| Impulse Buying Triggers | Financial Impact |

|---|---|

| Discount percentages | Increased unnecessary spending |

| Limited stock notifications | Fear of missing out (FOMO) |

| Bulk sale promotions | Excess inventory at home |

“The art of being wise is knowing what to overlook.” – William James

Stopping impulsive shopping takes effort. Set spending limits, make a budget, and think twice before buying on impulse. Your financial health depends on it.

Entertainment and Leisure Spending Pitfalls

Spending on entertainment can quickly empty your wallet if not managed well. In 2022, entertainment spending fell by 3.1%. This includes a 24.5% drop in spending on entertainment supplies and equipment. It’s crucial to have smart budgeting for leisure activities.

“Your entertainment budget doesn’t have to break the bank. Smart choices can help you enjoy life while maintaining financial discipline.”

It’s not about cutting out all fun. It’s about making smart, creative choices. Here are some ways to manage your leisure spending:

- Seek out free community events

- Use streaming service sharing options

- Look for discounted tickets and memberships

- Explore low-cost hobby alternatives

Tracking your entertainment spending can help you understand your habits. Many people spend a lot on leisure without realizing the impact on their finances.

| Entertainment Expense Category | Average Monthly Spending |

|---|---|

| Streaming Services | $45 |

| Dining Out | $120 |

| Movies and Events | $80 |

| Hobbies | $100 |

Pro tip: Allocate no more than 5-10% of your income to entertainment to maintain a balanced financial approach.

By using mindful budgeting and being careful with leisure spending, you can enjoy life without harming your finances.

Transportation and Vehicle Expenses

Transportation costs can really affect your money. The average American family spends $12,295 a year on getting around. It’s key to find ways to save on vehicle expenses.

Managing transportation costs needs smart planning and choices. If not done right, car expenses can eat into your budget.

Luxury Car Purchases: A Financial Drain

Luxury cars might look good, but they’re often a big money sink. Here are some tips to cut costs:

- Choose fuel-efficient models

- Opt for reliable, mid-range vehicles

- Avoid unnecessary high-end features

Fuel Management Strategies

Bad fuel use can hurt your wallet fast. Here are some tips to save:

- Maintain proper tire pressure

- Use apps to find cheapest gas prices

- Practice smooth acceleration

Reducing Maintenance Costs

Too much maintenance can cost a lot. Learn basic car care to avoid big bills:

| Maintenance Task | Potential Savings |

|---|---|

| Regular oil changes | $100-$300 annually |

| DIY air filter replacement | $20-$50 per service |

| Tire rotation | Extended tire life |

“Smart transportation choices can save you thousands each year.” – Financial Experts

By using these tips, you can cut down on transportation costs. This helps keep your finances in check.

Banking and Financial Service Fees

Your bank account might be quietly draining your finances through various hidden fees. It’s important to understand and minimize these unexpected expenses. Banks have many ways to charge money that can harm your financial health.

“Knowledge of banking fees is the first step to cutting expenses and protecting your hard-earned money.”

Let’s look at the most common banking fees that could be eating into your savings:

- Monthly maintenance charges

- ATM withdrawal fees

- Overdraft penalties

- Wire transfer costs

- Excessive transaction fees

Money-saving tips can help you avoid these financial traps. The average overdraft fee in 2024 is $27.08. This can quickly add up if you’re not careful. Some banks charge maintenance fees ranging from $5.47 to $15.45 for checking accounts.

| Fee Type | Average Cost | Potential Annual Impact |

|---|---|---|

| Overdraft Fee | $27.08 | Up to $324 yearly |

| Maintenance Fee | $15.45 | Up to $185 annually |

| Wire Transfer Fee | $26-$44 | Potentially $528 yearly |

Protect your finances by reading account agreements carefully. Maintain minimum balances and choose banks with fewer fees. Only 6% of banks avoid charging overdraft or nonsufficient funds fees. So, research is crucial for financial wellness.

Unused Memberships and Subscriptions

Your unused subscriptions are quietly eating away at your financial discipline. Recent research shows one-third of consumers spend $100 to $199 monthly on subscriptions. A staggering 42% continue to pay for services they rarely use.

Cutting expenses starts with understanding your subscription landscape. Take a critical look at your recurring charges. Ask yourself: Am I truly getting value from these services?

“Every unused subscription is money walking out of your wallet silently” – Financial Wisdom

Identify Your Subscription Culprits

- Review monthly bank statements

- Use subscription tracking apps

- Implement a quarterly subscription audit

- Cancel services you haven’t used in 60 days

Let’s break down potential annual costs of common subscriptions:

| Service | Monthly Cost | Annual Cost |

|---|---|---|

| Netflix (Standard) | $15.49 | $185.88 |

| Spotify Premium | $11.99 | $143.88 |

| YouTube TV | $72.99 | $875.88 |

Your budgeting strategies should include a systematic approach to managing subscriptions. Consider these practical tips:

- Set calendar reminders to review subscriptions

- Use built-in app features to track usage

- Opt for annual payments with potential discounts

- Share family plans when possible

By dedicating just one hour quarterly to subscription management, you could save hundreds of dollars annually. Embrace financial discipline and transform your approach to recurring expenses.

Credit Card and Debt Mismanagement

Credit card debt can grow fast if you’re not careful. It’s key to know the hidden dangers of credit cards. This helps keep your finances healthy and your budget in check.

Ignoring the risks of credit card use can quietly hurt your money. Let’s look at the main dangers that can trap you in debt:

High-Interest Rate Traps

Credit card interest rates can be very high. With rates around 16%, your debt can grow fast. Here are some scary facts:

- 40% of U.S. credit cardholders carry a monthly balance

- Interest rates can exceed 20% on some cards

- Not paying off balances can add hundreds or thousands to your debt

Minimum Payment Cycles

Only paying the minimum is a bad idea. It can make paying off your debt take years and cost a lot more.

| Payment Strategy | Total Interest Paid | Time to Pay Off Debt |

|---|---|---|

| Minimum Payments | $3,000+ | 10-15 years |

| Aggressive Payments | $500-$1,000 | 2-3 years |

Late Payment Penalties

Late payments can really hurt your finances. A late payment can:

- Bring on penalty fees

- Make your interest rate go up

- Lower your credit score by up to 200 points

“Your credit score is your financial reputation – protect it fiercely.” – Financial Expert

To avoid these traps, use debt management strategies like the Debt Avalanche method. It can save you 10-20% in interest. Make a budget, focus on high-interest debt, and think about consolidation to take back control of your money.

Conclusion: Breaking Free from Wasteful Money Habits

Developing financial discipline is key to changing your financial future. With 62% of people not budgeting, you can stand out by spending mindfully. Tracking your spending and understanding your habits can cut down on waste and build wealth.

Financial literacy is about getting better over time. Tools like YNAB, Mint, and Tiller help you see your spending. Start by reviewing your expenses monthly and making a budget that fits your goals. Small changes can add up to big savings.

Getting financially healthy takes commitment and self-awareness. Use automated savings, review budgets regularly, and plan smart investments. Cutting down on impulse buys, getting better deals, and making smart choices can free you from bad money habits. This leads to a more secure financial future.

The journey to financial freedom starts with knowing your spending habits and making changes. Embrace financial discipline, use technology, and focus on your long-term financial health. Your future self will appreciate the smart choices you make now.

FAQ

How much money can I potentially save by breaking these wasteful spending habits?

You could save hundreds or thousands of dollars a year by changing your spending habits. Simple actions like making coffee at home and cutting back on subscriptions can make a big difference. These small changes add up over time.

What are the most common financial habits that waste money?

Common money-wasting habits include eating out too much and buying new tech too soon. Impulse shopping online and unused subscriptions also waste money. So does spending too much on coffee and buying only brand names. Poor credit card use is another area to improve.

How can I stop impulse buying?

To stop impulse buying, wait 24 hours before buying non-essential items. Unsubscribe from marketing emails and avoid shopping when you’re feeling emotional. Use cash instead of credit cards and stick to a budget that allows for some fun spending.

Are small expenses really that significant to my overall financial health?

Yes! Small expenses like daily coffee and subscriptions can add up to a lot of money each year. These small costs often go unnoticed but can really hurt your finances in the long run.

How do I track my spending to identify wasteful habits?

Use budgeting apps or spreadsheets to track your spending. Review your bank statements monthly and categorize your spending. Look for recurring costs and unnecessary subscriptions. This helps you find areas to cut back without giving up too much.

What’s the best way to reduce food-related expenses?

Plan your meals and cook at home more often. Buy groceries with a list and use bulk purchases. Limit dining out and food delivery. Compare prices and use loyalty programs. Avoid shopping when you’re hungry to prevent impulse buys.

How can I manage technology-related expenses more effectively?

Regularly review your subscriptions and avoid unnecessary tech upgrades. Use free alternatives and take advantage of bundled services. Negotiate better rates and evaluate the value of each digital service you pay for.

What strategies can help me avoid credit card debt?

Stick to a strict budget and pay more than the minimum on your credit cards. Avoid using them for everyday expenses. Build an emergency fund and negotiate lower interest rates. Consolidate high-interest debt and use credit wisely.

How do I break the cycle of unnecessary spending?

Start by tracking your spending and creating a realistic budget. Distinguish between needs and wants and practice mindful spending. Set financial goals and automate your savings. Regularly review and adjust your financial plans.

Can changing these habits really improve my financial future?

Yes! Developing financial discipline and mindful spending can greatly improve your financial health. By making smart choices, you can save money, reduce debt, and secure a stable financial future.

1 thought on “15 Habits That Waste Money”